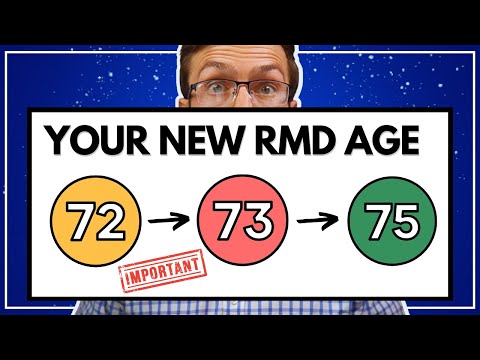

There are some massive changes coming to required minimum distributions in 2025 and Beyond in today's video we're going to talk about three of those major changes let's get into it in the annual exercise of how will Congress spend the tax dollars that we don't have on December 23rd Congress passed the Consolidated Appropriations Act of 2025. this is also being dubbed securact 2.0 and this is a massive 4 000 page bill that contains 1.7 trillion dollars in spending now there are a lot of different retirement related changes as part of this bill I plan on recording a series that talks about a lot of these changes in individual videos in today's video I want to focus on these rmd changes because I think this is one of the biggest changes that's part of this build now the biggest of these rmd adjustments comes in the changing of the age you must begin at your rmds now this is all going to be tied to your birth year and so if you're someone who's born 1950 or earlier your rmd age will be 72 or 70 and a half if you began those rmds prior to 2025. so if you were born 1950 or earlier there really aren't going to be too many major changes coming to when you file for your rmds but everybody born after will see a major change here if you were born somewhere between 1951 and 1959 your new updated rmdh will be age 73 and for those born 1960 or later you'll see your rmd age adjust all the way up to age 75. now this was an rmd change that was long awaited in my opinion this will give relief to numerous retirees thus pushing back that age that you...

Award-winning PDF software

How to prepare Rut 75 Tax Form

About Rut 75 Tax Form

The Rut 75 tax form is a document used in the state of Vermont in the United States. More specifically, it is a Certificate of Exemption form for Property Purchased for Resale. This form allows registered retailers and wholesalers to claim exemption from paying sales tax on merchandise that is purchased for resale purposes. Retailers and wholesalers who engage in buying and selling goods for resale are the individuals or businesses who need the Rut 75 tax form. By completing and submitting this form to the Vermont Department of Taxes, they can provide proof of their exempt status and avoid paying sales tax on eligible purchases. This form helps ensure that sales tax is properly applied and collected only once when the merchandise is ultimately sold to the end consumer.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Rut 75 tax form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Rut 75 Tax Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our Assistance team.

- Place an electronic digital unique in your Rut 75 Tax Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Rut 75 Tax Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

What people say about us

E-papers are far far better protected

Video instructions and help with filling out and completing Rut 75 Tax Form